Making a big business move often feels like standing at a crossroads. Should you launch that new product line, invest in state-of-the-art machinery, or perhaps expand into a new market? The stakes are high, and gut feelings won't cut it. That's where a Detailed Cost-Benefit Analysis steps in, offering a systematic, data-driven flashlight to illuminate the path forward. It’s about more than just numbers; it’s about clarity, foresight, and ultimately, making choices you can stand by.

Think of it as your most trusted advisor, meticulously laying out every potential upside and downside of a decision, assigning a monetary value to even the most elusive factors. Originating from early economic theories and refined over the past century, this powerful tool helps you determine if the expected advantages truly outweigh the anticipated costs, guiding your business toward smarter, more informed investments.

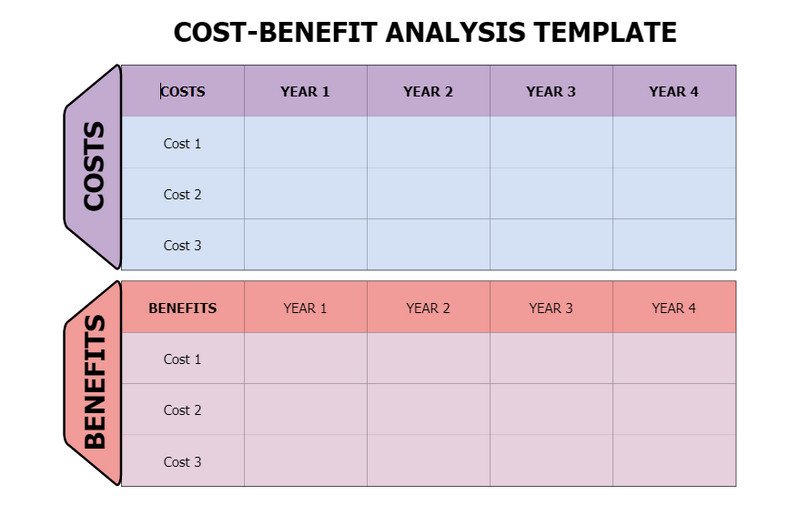

At a Glance: Your Cost-Benefit Analysis Toolkit

- What it is: A systematic process comparing total expected benefits against total anticipated costs of a project or decision.

- Why use it: To make data-driven, informed business choices, beyond just intuition.

- Key focus: Assigning monetary values to both tangible (easy-to-measure) and intangible (harder-to-measure) factors.

- Crucial concept: Understanding the understanding opportunity cost – what you give up by choosing one option over another.

- What it helps you do: Evaluate project feasibility, compare alternatives, and prioritize investments.

- Biggest challenge: Accuracy of forecasting and assumptions; garbage in, garbage out.

- Not always for: Very small, low-risk decisions or extremely large, long-term projects with high uncertainty in future economic factors.

Beyond the Gut: Why Detailed CBA Matters More Than Ever

In today's fast-paced market, "winging it" is a recipe for disaster. Every significant decision, from a minor process improvement to a multi-million-dollar acquisition, carries financial implications and risks. A Detailed Cost-Benefit Analysis (CBA) empowers you to move past assumptions and emotional biases, grounding your choices in concrete data.

It's not just about approving or rejecting a project. A well-executed CBA can also help you optimize resource allocation, identify potential risks before they materialize, and even strengthen your negotiation position. It creates a common language for stakeholders, ensuring everyone understands the rationale behind a decision. Ultimately, it’s a strategic planning essential that helps you build a more resilient and profitable business. Understanding What is Strategic Planning? is often the first step before diving into a CBA for individual projects.

The 6-Step Blueprint for a Robust Cost-Benefit Analysis

Conducting a thorough CBA isn't a one-and-done calculation; it's a methodical exploration. Each step builds on the last, ensuring you cover all bases.

Step 1: Setting the Stage and Exploring Your Options

Before you start crunching numbers, you need a crystal-clear understanding of what you're trying to achieve and all the possible ways to get there.

- Define the Problem/Opportunity: What challenge are you trying to solve, or what opportunity are you hoping to seize? Is it streamlining operations, increasing market share, or responding to a new competitor?

- Establish Project Scope and Goals: Clearly delineate the boundaries of the project. What's in, what's out? What specific, measurable goals will define success? Without clear goals, your analysis lacks a target.

- Identify All Viable Alternatives: This is critical. Don't just consider the "big idea." Include all plausible options, even those that seem less glamorous initially. Crucially, always include the "status quo" – doing nothing new – as a benchmark. This allows you to compare the proposed project against your current baseline, offering a vital comparison point.

- Set Parameters and Timelines: What's the anticipated lifespan of the project or decision you're analyzing? A 5-year, 10-year, or even 20-year horizon? This timeline will impact how you forecast costs and benefits.

- Identify Key Stakeholders: Who will be affected by this decision? Employees, customers, investors, suppliers, regulators? Their input can be invaluable for identifying hidden costs or benefits.

Example: A manufacturing company considers upgrading its assembly line. Alternatives include: 1) doing nothing (status quo), 2) a partial upgrade of specific machines, 3) a full overhaul with advanced robotics.

Step 2: Unearthing Every Cost – Seen and Unseen

This is where you dig deep, categorizing and quantifying every expense associated with each alternative. Remember, costs aren't just what you write checks for.

- Direct Costs: These are straightforward expenses directly tied to the project.

- Examples: Labor wages, raw materials, equipment purchases, software licenses, consulting fees.

- Indirect Costs: Overheads not directly traceable to a single project but necessary for operation.

- Examples: Utilities, administrative salaries, rent, general marketing, insurance, maintenance.

- Intangible Costs: Often overlooked, these are non-monetary impacts that can still have a significant financial ripple effect. Assigning a monetary value here requires careful estimation.

- Examples: Decreased employee morale during a transition, negative impact on customer satisfaction due to service disruptions, damage to brand reputation from a poorly executed launch, increased stress on management.

- Opportunity Costs: This is the value of the next best alternative you forgo when making a choice. If you invest in Project A, you can't invest in Project B, and the benefits of Project B become an opportunity cost. Understanding opportunity cost is fundamental to holistic decision-making.

- Example: If you choose to invest $1 million in a new marketing campaign, you miss out on the potential returns from investing that same $1 million in R&D for a new product.

- Costs of Potential Risks: What if things go wrong? Estimate the potential financial impact of project delays, technical failures, regulatory non-compliance, or market shifts.

- Classification: Group costs as fixed (rent, insurance), variable (materials per unit), recurring (monthly software subscription), or one-time expenses (initial equipment purchase). This helps in forecasting.

Practical Tip: Involve department heads and subject matter experts from finance, operations, HR, and legal to ensure no cost is missed. Their insights are invaluable for accurate estimation.

Step 3: Pinpointing and Monetizing Your Benefits

Now for the good news: identifying all the positive outcomes. Just like costs, benefits come in tangible and intangible forms, and you need to assign a monetary value to both. Be conservative in your estimates to avoid over-optimism.

- Explicit (Financial) Benefits: These are the easily quantifiable financial gains.

- Examples: Increased revenue/sales, reduced operating costs (e.g., energy savings, automation efficiencies), tax credits, faster time-to-market, improved cash flow, asset value appreciation.

- Implicit (Non-Financial) Benefits: These are harder to put a number on but can profoundly impact long-term success. Your task is to translate these into conservative monetary equivalents.

- Examples: Improved employee morale (leading to higher productivity, lower turnover), greater customer satisfaction (leading to repeat business, positive reviews, higher lifetime value), enhanced brand reputation, competitive advantage (e.g., first-mover advantage, proprietary technology), expanded market share, improved safety records (reducing liability costs), regulatory compliance (avoiding fines).

Monetizing Intangibles: - Improved Employee Morale: Estimate reduced turnover costs (recruitment, training), increased productivity (hours saved per employee), or fewer sick days.

- Greater Customer Satisfaction: Project higher customer retention rates, increased average purchase value, or the value of positive word-of-mouth referrals.

- Enhanced Brand Reputation: Quantify increased market share or ability to command premium pricing due to stronger brand perception.

Example: A new customer service software might reduce average call times (direct cost saving) and improve customer satisfaction (implicit benefit, leading to higher customer retention, which can be monetized).

Step 4: Making Sense of Money Over Time – The Time Value of Money

A dollar today is worth more than a dollar tomorrow. Inflation, investment opportunities, and risk erode the purchasing power of future money. To compare costs and benefits fairly across different periods, you must account for the Time Value of Money (TVM).

- Discounting: This process converts all future cash flows (both costs and benefits) to their equivalent value in today's dollars, known as Present Value (PV).

- Discount Rate: This is the crucial factor. It represents the rate of return you could earn on an alternative investment of similar risk, or your company's cost of capital. A higher discount rate means future money is worth less in today's terms. Selecting the right discount rate is critical and often requires careful consultation with finance professionals.

- Net Present Value (NPV): After discounting all future costs and benefits, you sum them up. A positive NPV indicates the project is expected to generate more value than it costs, in today's dollars.

Quick Clarification: If you spend $10,000 today and expect to receive $11,000 a year from now, that $11,000 isn't really an 10% return if inflation is 3% and your cost of capital is 7%. Discounting brings that $11,000 back to its present-day equivalent value for a true apples-to-apples comparison.

Step 5: Stress-Testing Your Analysis and Quantifying Risk

Numbers on a spreadsheet are only as good as the assumptions behind them. This step is about challenging those assumptions and understanding the potential volatility.

- Calculate Key Metrics:

- Net Present Value (NPV): As mentioned, the sum of all discounted benefits minus the sum of all discounted costs. A positive NPV suggests the project is financially viable.

- Benefit-Cost Ratio (BCR): Total discounted benefits divided by total discounted costs. A BCR greater than 1.0 means benefits outweigh costs.

- Return on Investment (ROI): Measures the efficiency of an investment, often expressed as a percentage. Knowing how to calculate ROI is essential for evaluating the profitability of a project relative to its cost.

- Sensitivity Analysis: What happens if your optimistic sales forecast is off by 10%? Or if material costs increase by 5%? Sensitivity analysis involves changing one variable at a time (e.g., sales volume, cost of materials, discount rate) to see how the NPV or BCR changes. This helps identify the variables that have the biggest impact on your project's viability.

- Scenario Planning: Look at best-case, worst-case, and most-likely scenarios. This provides a range of potential outcomes, giving you a more realistic picture of risk.

- Assess Non-Financial Factors: Not everything can or should be monetized directly. Systematically evaluate factors like strategic alignment, regulatory compliance, public perception, or ethical considerations. You can establish scoring rules and assign weighting factors to reflect their relative importance. For instance, a project might have a slightly lower NPV but be crucial for regulatory compliance, making it a priority.

Example: A solar panel installation project might have an NPV calculated with average electricity prices. Sensitivity analysis would show how NPV changes if energy prices fluctuate significantly, or if government incentives are reduced.

Step 6: Weighing Your Choices and Making the Call

With all the data gathered and analyzed, it's time to make a recommendation. This isn't just about picking the project with the highest NPV; it's a holistic decision.

- Compare Alternatives: Pit each viable option against the "status quo" and against each other. Look at the NPV, BCR, and ROI for each, but also consider the non-financial scores and risk profiles.

- Data-Backed Recommendation: Your recommendation must be clearly supported by your analysis. Explain the financial, non-financial, and risk consequences of each alternative.

- Consider Strategic Context: Does the project align with your overall business strategy, brand image, and long-term goals? A project might look good on paper but contradict your company's core values or strategic direction.

- Resource Constraints: Even with a positive CBA, you might have capital limitations or human resource constraints that prevent you from pursuing every beneficial project. You can't say "yes" to everything, and financial modeling for startups is particularly important for newer companies to understand these constraints.

- Monitoring and Evaluation: Your work isn't done post-approval. Implement a system to monitor the chosen investment to ensure it delivers the expected value. Track actual costs and benefits against your projections. This feedback loop is vital for refining future CBA processes and ensuring project management best practices are followed.

Important Note: Not all projects with a positive CBA should be automatically accepted. Strategic fit, resource availability, and organizational capacity play equally important roles in the final decision.

When is a Detailed CBA Your Best Play?

A Detailed Cost-Benefit Analysis is a powerful tool, but it's not always necessary or practical. It truly shines when:

- You're evaluating significant capital investments: New equipment, facility expansion, major software implementation.

- Considering new product development or market entry: Understanding potential returns vs. development and launch costs.

- Assessing process improvements: Weighing the cost of change against efficiency gains.

- Making strategic hiring decisions: Analyzing the long-term value a new role brings against salary and overhead.

- Comparing multiple project alternatives: Helping you prioritize and select the option that offers the greatest overall value.

- Justifying a decision to stakeholders: Providing a robust, data-backed rationale for a course of action.

While a quick back-of-the-envelope calculation might suffice for small, low-risk decisions, the more complex, expensive, and long-term a decision, the more vital a Detailed CBA becomes.

Common Pitfalls to Avoid in Your CBA

Even seasoned analysts can fall into traps. Be aware of these common missteps:

- Omitting Intangible Costs/Benefits: Failing to quantify the harder-to-measure factors can drastically skew your results, leading to an incomplete picture.

- Overly Optimistic Projections: Humans naturally tend towards optimism. Be conservative in your benefit estimations and realistic (or even slightly pessimistic) in your cost forecasts. Independent review can help here.

- Ignoring Opportunity Costs: Forgetting what you lose by choosing one path can lead to overlooking better alternatives.

- Inaccurate Discount Rate: An incorrectly chosen discount rate can significantly distort the present value of future cash flows, making a project appear more or less attractive than it truly is.

- Scope Creep: Allowing the project scope to expand without updating the CBA invalidates your initial analysis. Continuous monitoring is key.

- Confirmation Bias: Actively seeking data that confirms your preferred outcome, rather than objectively assessing all information.

- Not Accounting for Risk: Failing to conduct sensitivity analysis or scenario planning leaves you vulnerable to unforeseen changes.

Quick Answers to Your Cost-Benefit Analysis Questions

What's the main difference between CBA and ROI?

A Cost-Benefit Analysis (CBA) provides a holistic view, comparing all expected costs (tangible and intangible) against all expected benefits (monetized tangible and intangible) to determine overall feasibility and value. It often results in an NPV or BCR. Return on Investment (ROI), on the other hand, is a specific financial metric, usually expressed as a percentage, that measures the profitability of an investment relative to its initial cost. While ROI is a component within a CBA, CBA is a broader framework that considers more factors beyond just direct financial return.

Can a CBA be used for personal decisions?

Absolutely! While the terminology might seem corporate, the underlying logic of a CBA applies to many personal choices. Deciding whether is Chase Sapphire Reserve worth it involves weighing annual fees, travel benefits, sign-up bonuses, and point redemption values against other credit card options or even just saving money. Similarly, buying a home, choosing a college, or even making a major purchase like a car can benefit from a personal cost-benefit analysis.

How do you value intangible benefits?

Valuing intangibles is challenging but crucial. You can use several techniques:

- Proxy values: Look for similar situations where an intangible benefit (like improved safety) led to quantifiable savings (e.g., reduced insurance premiums, fewer lost workdays).

- Surveys/Interviews: Ask stakeholders how they would value certain improvements or avoided negative impacts.

- Willingness-to-pay: How much would customers pay for an improved service, or employees for better working conditions?

- Expert opinion: Consult industry experts who have experience quantifying similar impacts.

The key is to be consistent, transparent about your assumptions, and always err on the side of conservatism.

Is a CBA always quantitative?

While a Detailed CBA strives to quantify as much as possible in monetary terms, it's not solely quantitative. The systematic evaluation of non-financial factors (e.g., strategic alignment, ethical considerations, regulatory impact) is an integral part. These qualitative elements provide essential context and can override purely financial metrics, especially if they carry significant strategic weight or risk. The goal is an informed decision, which blends numbers with nuanced judgment.

Moving Forward with Confidence

A Detailed Cost-Benefit Analysis is more than just a financial exercise; it's a discipline that fosters clarity, accountability, and strategic foresight. By methodically identifying, quantifying, and comparing costs and benefits, you transform complex decisions into manageable analyses. It allows you to anticipate challenges, mitigate risks, and ultimately, steer your business toward its most prosperous future. The effort you put into a thorough CBA today will pay dividends in the clarity and confidence you gain for every major choice tomorrow.