The landscape of premium travel cards just got a seismic shake-up. For years, the Chase Sapphire Reserve (CSR) stood as an undisputed titan, a go-to for savvy travelers seeking luxury perks and flexible points. But with its annual fee jumping to a hefty $795 by June 2025, and other key benefits shifting, many are asking: does the Chase Sapphire Reserve still reign supreme, or do competitors now offer a better premium travel value?

This isn't just about a price tag; it's about a complete re-evaluation of your travel strategy. As a seasoned journalist and subject-matter expert, I'm here to help you navigate these changes, understand the real implications, and arm you with the knowledge to make the smartest decision for your wallet and your wanderlust.

At a Glance: Your Premium Card Cheat Sheet

- The Chase Sapphire Reserve (CSR) is getting more expensive: Annual fee up to $795 (June 2025), authorized user fees to $195.

- Point redemption is changing: The beloved 50% redemption boost through Chase Travel is being replaced by a new "Points Boost" program, though you have a grace period until October 2027.

- Key benefits remain: The $300 annual travel credit, Global Entry/TSA PreCheck, Priority Pass lounge access, and robust travel protections are staying put.

- It's time to re-evaluate: The increased cost means you need to scrutinize whether the benefits still outweigh the fees for your specific travel style.

- Strong contenders exist: Whether you want to stay within Chase's ecosystem, prefer another premium card, or prioritize hotels or dining, there are excellent alternatives.

The Shifting Sands of Premium Travel: What Changed for the Chase Sapphire Reserve?

For years, the Chase Sapphire Reserve was the gold standard for many, a card that blended lucrative rewards with practical, high-value travel benefits. Its $550 annual fee, while steep, often felt justified by its $300 annual travel credit, making the effective annual fee much lower. The 50% redemption bonus on points when booking through Chase Travel was a cornerstone, effectively making each Ultimate Rewards point worth 1.5 cents towards travel.

However, the world of premium credit cards is dynamic, and even the giants must adapt. As of June 2025, the Chase Sapphire Reserve's annual fee is increasing to a substantial $795. Authorized user fees are also climbing from $75 to $195.

Perhaps the most significant shift for points enthusiasts is the planned replacement of the 50% redemption boost through Chase Travel. This benefit, which made 100,000 Ultimate Rewards points worth $1,500 towards travel booked via Chase, will be phased out for new redemptions. In its place, Chase is introducing a new "Points Boost" program. While details are still emerging, existing cardholders have a generous two-year grace period until October 26, 2027, to continue enjoying the current 50% bonus or leverage the new Points Boost, whichever offers better value.

On the brighter side, several highly valued benefits are sticking around. You'll still enjoy that easy-to-use $300 annual travel credit, reimbursement for Global Entry/TSA PreCheck/NEXUS application fees, access to over 1,300 airport lounges worldwide through Priority Pass Select, and comprehensive travel protections including primary rental car insurance, trip cancellation/interruption insurance, and baggage delay insurance. The CSR continues to offer lifestyle perks like subscriptions to Apple Music, Apple TV+, DoorDash DashPass, and $300 in annual statement credits for StubHub and viagogo. You'll also still earn 8x points on all purchases through Chase Travel (including their new "The Edit" hotel collection) and 4x points on flights and hotels booked direct.

These changes, particularly the fee hike and the redemption shift, compel a serious look at whether the CSR continues to align with your financial goals and travel habits. It's time to ask: Is the Sapphire Reserve worth it? for you anymore?

Why Your Premium Card Strategy Needs a Rethink Now

The higher annual fee for the Chase Sapphire Reserve means your "break-even" point has moved. Previously, the $300 travel credit effectively brought the annual fee down to $250. With the new $795 fee, that same $300 credit only brings it down to $495. That's a significantly higher hurdle to clear with the card's remaining benefits.

This isn't to say the CSR is suddenly worthless. Its retained benefits, particularly the travel credit and lounge access, are still valuable. The excellent travel protections can save you thousands in unexpected situations. However, the value proposition has undoubtedly shifted. You'll need to meticulously evaluate how much you actually use all the perks—from the lounge access to the various subscriptions and credits—to determine if the new, higher fee is truly justified.

This is especially true if you don't frequently book through Chase Travel, or if the new Points Boost program doesn't align with your redemption preferences as well as the old 50% bonus did. The increased authorized user fees are also a factor if you share card benefits with family members. For many, this re-evaluation will lead to exploring alternatives that might offer more value for their specific spending and travel patterns.

Navigating Your Options: Staying Within the Chase Ecosystem

If you love Chase Ultimate Rewards points and prefer to keep your financial life streamlined with one issuer, you still have excellent options beyond the Chase Sapphire Reserve.

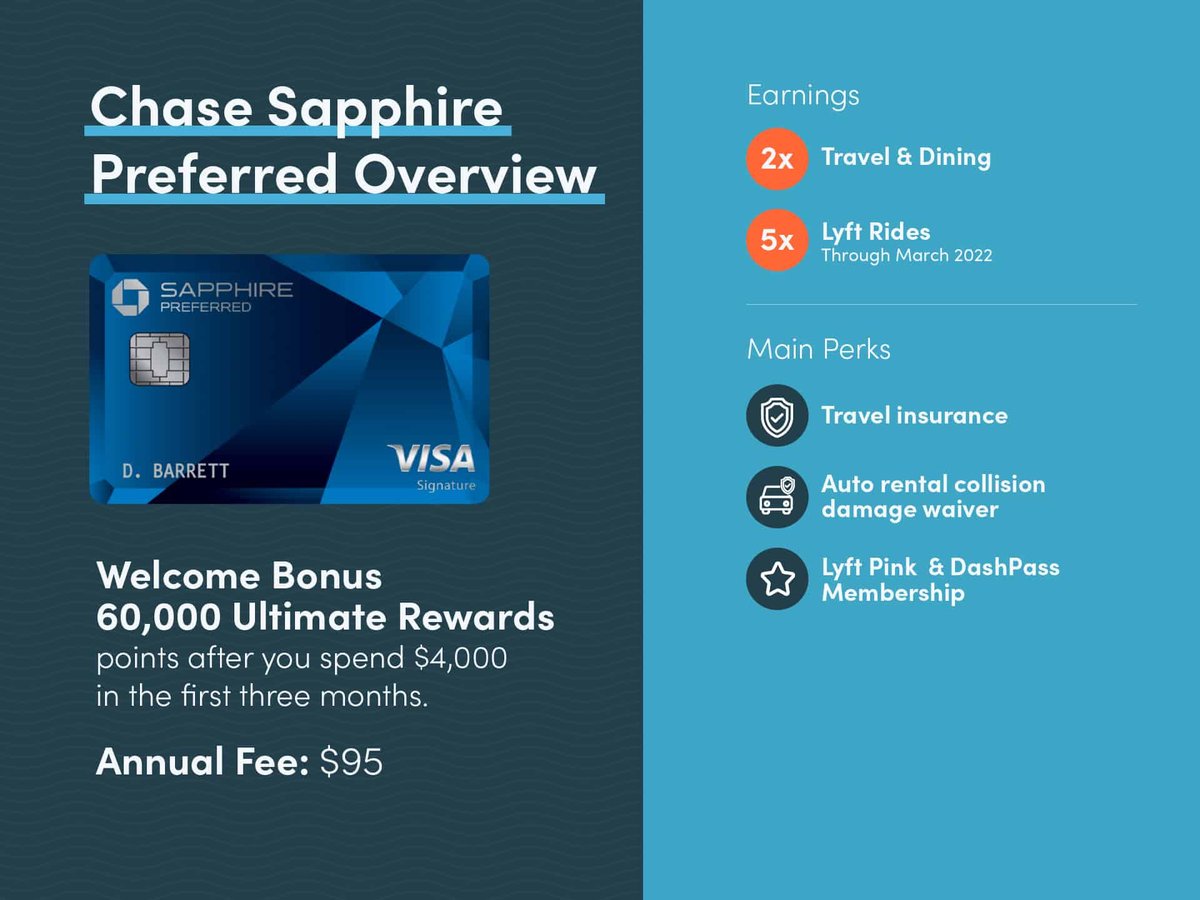

The Savvy Traveler's Choice: Chase Sapphire Preferred Card

Often hailed as one of the best starter travel cards, the Chase Sapphire Preferred (CSP) offers a fantastic entry point into the world of transferable points without the premium price tag.

- Annual Fee: A very reasonable $95.

- Key Benefits:

- Points Earning: Earns 5 points per dollar on travel booked through Chase Travel, 3 points per dollar on dining, 2 points per dollar on all other travel, and 1 point per dollar on everything else.

- Redemption Value: While it doesn't offer the CSR's 50% boost, CSP cardholders still get a 25% boost when redeeming points for travel through Chase Travel (making points worth 1.25 cents each). You can also transfer points 1:1 to numerous airline and hotel partners, just like with the CSR.

- No Foreign Transaction Fees: Ideal for international travel.

- Travel Protections: Offers solid travel insurance, including primary rental car insurance and trip cancellation/interruption.

- Who It's For: The CSP is perfect for those who want access to the powerful Chase Ultimate Rewards program for a modest annual fee. It's great for people who travel a few times a year, dine out regularly, and appreciate solid travel insurance, but don't need luxury perks like airport lounge access. It’s also an excellent choice for those looking to build a Chase "trifecta" for maximizing rewards.

The Strategic Move: Downgrading Your Chase Sapphire Reserve

If the new CSR fee is simply too much to justify, but you want to preserve your Ultimate Rewards points and credit history, downgrading is a smart play.

- Why Downgrade Instead of Cancel?

- Preserve Points: By product changing to another Chase card, your Ultimate Rewards points remain in your account. If you outright cancel a card that earns UR points, you risk forfeiting those points.

- Maintain Account Age: Downgrading keeps your account open, preserving its age on your credit report. This is beneficial for your credit score, as average age of accounts is a factor.

- Avoid Credit Score Hit: Closing a credit card can temporarily lower your credit score by reducing your total available credit and shortening your average account age.

- How to Downgrade:

- Wait 12 Months: Your account must be open for at least 12 months before you can product change. This is a federal regulation.

- Choose Your Card: Popular downgrade options include the Chase Sapphire Preferred (for continued travel rewards) or a no-annual-fee card like the Chase Freedom Unlimited (earns 1.5% cash back, keeps points alive, and allows for point pooling to a Sapphire card later if you get one).

- Contact Chase: Call the number on the back of your card or send a secure message through your online account to request a product change. Be clear about which card you want to switch to.

- Things to Note:

- You generally won't receive a welcome bonus for a product change.

- If you downgrade to a no-annual-fee card, you might lose some travel protections.

- Any annual fee charged recently should be pro-rated or refunded if you downgrade soon after it posts.

Stepping Outside Chase: Top Premium Travel Card Competitors

If Chase's ecosystem no longer holds the exclusive appeal it once did, the market is rich with other premium travel cards vying for your attention. Each offers a distinct blend of benefits, appealing to different types of travelers.

The All-Around Contender: Capital One Venture X Rewards Credit Card

The Capital One Venture X burst onto the scene as a formidable challenger, offering premium perks at a significantly lower annual fee than the CSR.

- Annual Fee: A competitive $395.

- Key Benefits:

- Annual Travel Credit: A straightforward $300 annual travel credit for bookings made through Capital One Travel.

- Annual Bonus Miles: Receive 10,000 bonus miles annually on your account anniversary (worth approximately $185 based on July 2025 valuations), which helps offset the fee further.

- Lounge Access: Comprehensive access to Priority Pass lounges, Capital One Lounges, and Plaza Premium Lounges. Important note: As of February 1, 2026, additional Venture X cardholders will no longer receive complimentary lounge access; primary cardholders can add access for $125 per card.

- Earning Rates: Earns a solid 2 miles per dollar on every purchase, plus an impressive 10 miles per dollar on hotels and rental cars booked through Capital One Travel.

- No-Annual-Fee Authorized Users: A huge plus for families or those who want to share benefits without extra cost (though lounge access for AUs will change).

- Global Entry/TSA PreCheck Credit: Reimbursement for application fees.

- Who It's For: The Venture X is an excellent choice for general travelers who want premium perks like lounge access and a travel credit, appreciate simple earning rates, and desire a lower annual fee than the CSR or Amex Platinum. Its universal 2x earning makes it a strong everyday card, and the anniversary miles add consistent value.

For the Hotel Loyalist: Hilton Honors American Express Aspire Card

If your travel world revolves around Hilton properties, no card offers more dedicated value than the Hilton Aspire. This card is a masterclass in co-branded luxury for a specific brand.

- Annual Fee: $550.

- Key Benefits:

- Automatic Hilton Diamond Status: This is huge for Hilton regulars, offering executive lounge access, complimentary breakfast, space-available room upgrades, and higher earning rates on paid stays.

- Free Night Rewards: Receive one Free Night Reward annually upon renewal, valid at nearly any Hilton property worldwide. Earn a second Free Night Reward after spending $30,000 in a calendar year. These can be incredibly valuable.

- Hilton Resort Credits: Up to $400 in Hilton resort statement credits annually, disbursed as up to $200 semi-annually.

- Airline Incidental Fee Credits: Up to $200 in statement credits annually for incidental fees charged by your selected airline.

- Priority Pass Select: Airport lounge access, ensuring comfort before flights.

- Who It's For: This card is unequivocally for the frequent Hilton guest. If you regularly stay at Hilton properties and can maximize the Diamond status, free nights, and resort credits, the card's value far outstrips its annual fee. If you rarely stay at Hiltons, look elsewhere.

The Dining Dynamo: American Express Gold Card

While not a premium travel card in the same vein as the CSR or Venture X, the Amex Gold is a powerhouse for everyday spending categories, making it a valuable addition to many wallets.

- Annual Fee: $325.

- Key Benefits:

- Unrivaled Dining & Supermarket Rewards: Earns an exceptional 4 points per dollar on restaurants worldwide (including takeout and delivery, up to $50,000 per year) and 4 points per dollar at U.S. supermarkets (up to $25,000 per year).

- Flight Rewards: Earns 3 points per dollar on flights booked directly with airlines or amextravel.com.

- Dining Credits: Up to $120 in dining credits annually (disbursed as $10/month statement credits, enrollment required for select partners like Uber Eats, Grubhub, Shake Shack, and others).

- Uber Cash: Up to $120 in Uber Cash annually ($10/month, enrollment required), which can be used for Uber rides or Uber Eats.

- Who It's For: The Amex Gold is ideal for individuals or families with significant spending on dining out and groceries. If you can consistently use the monthly dining and Uber credits, they effectively reduce the annual fee, leaving you with fantastic rewards on everyday essentials. It pairs well with a separate card for general travel perks or non-bonus spending.

The Head-to-Head Battle: Amex Platinum vs. The New Chase Sapphire Reserve (2026 Perspective)

When it comes to top-tier, ultra-premium travel cards, the American Express Platinum Card and the Chase Sapphire Reserve are perennial rivals. With the CSR's new fee structure, this comparison becomes even more critical. Both cards offer extensive perks, but they clearly cater to distinct preferences and spending patterns. Let's break down how they stack up, keeping the 2026 changes in mind.

| Feature | American Express Platinum Card (2026) | Chase Sapphire Reserve (2026) |

|---|---|---|

| Annual Fee | $895 | $795 |

| Key Travel Perks | $600 Annual Hotel Credits: (prepaid Amex Travel at Fine Hotels + Resorts or The Hotel Collection, $300 semi-annually). $209 CLEAR® Plus Credit $200 Airline Fee Credits $200 Uber Cash ($15/month + $35 in Dec) $120 Uber One Credits Global Entry/TSA PreCheck/NEXUS Credit | $300 Annual Travel Credit: Highly flexible for almost any travel expense. $500 for "The Edit" Hotels: (Chase's curated luxury hotel collection) $120 Annual Lyft Credits Global Entry/TSA PreCheck/NEXUS Credit |

| Lounge Access | Most Extensive: Access to over 1,550 airport lounges worldwide, including The Centurion Lounges, Priority Pass Select (enrollment required), Delta Sky Clubs (when flying Delta), Plaza Premium, and more. | Extensive: Access to over 1,300 airport lounges worldwide via Priority Pass Select (enrollment required) and the new Chase Sapphire Lounges (limited but growing). |

| Earning Rates | 5X Points: On flights booked directly with airlines or American Express Travel (up to $500,000 per calendar year). 5X Points: On prepaid hotels booked with American Express Travel. 1X Point: On all other eligible purchases. | 8X Points: On all purchases through Chase Travel (including The Edit). 4X Points: On flights and hotels booked direct. 3X Points: On dining. 1X Point: On all other purchases. |

| Lifestyle Perks | Various digital entertainment credits, Saks Fifth Avenue credits, Equinox credits, Resy Global Dining Access. | Subscriptions to Apple Music, Apple TV+, DoorDash DashPass. $300 Annual Statement Credits for StubHub and viagogo. |

| Welcome Offers | Can be as high as 175,000 Membership Rewards Points (worth $1,750 for travel at $0.01/point, potentially more with transfer partners). | Typically around 125,000 bonus points (worth at least $1,250 for travel at $0.01/point via Chase Travel, potentially more with transfer partners). |

| Overall Tangible Value (Estimated) | Over $1,300 in annual travel perks (based on full utilization of all credits). | Approximately $920 in tangible yearly travel perks (based on full utilization of $300 travel credit, $500 "The Edit" credit, $120 Lyft credit). |

| Ideal For | Frequent flyers who prioritize luxury airport experiences, often fly Delta, use CLEAR, stay at Fine Hotels + Resorts, and can maximize Amex's extensive list of statement credits. | Travelers who value a highly flexible travel credit, appreciate robust travel protections, can utilize Chase's "The Edit" collection, and benefit from the dining and general travel earning rates. Also strong for those who value Apple and DoorDash subscriptions. |

| Foreign Transaction Fees | None | None |

| Authorized Users | $195 per card for Platinum Authorized Users (who receive many of the same benefits, including lounge access). | $195 per card (receive many of the same benefits, including lounge access). |

| Key Differentiators: |

- Lounge Access: Amex Platinum offers arguably the best lounge network, particularly if you fly Delta frequently or live near a Centurion Lounge. The CSR's Priority Pass is excellent, but its proprietary lounges are still few.

- Travel Credits: The CSR's $300 travel credit is incredibly versatile—it automatically applies to almost any travel purchase. Amex Platinum's credits are more specific and often require pre-booking through Amex Travel or selecting an airline, demanding more effort to maximize.

- Hotel Focus: Amex Platinum leans heavily into luxury hotels through its Fine Hotels + Resorts and The Hotel Collection programs. The CSR now introduces its own "The Edit" collection with a substantial credit. Your preferred hotel brands will matter here.

- Earning Strategy: Amex Platinum excels on direct airline bookings and prepaid hotels through Amex. The new CSR will offer a massive 8x on Chase Travel bookings and a strong 4x on direct flights/hotels, plus 3x on dining, making it a more versatile earner for diverse travel expenses.

- Lifestyle Perks: Amex has a broader, more diverse (and sometimes more complex) array of lifestyle credits. The CSR's are more targeted towards specific subscriptions and entertainment/events (StubHub/viagogo).

The choice between the Amex Platinum and the revamped CSR boils down to your personal travel style and how well you can integrate their unique benefits into your life. Are you an Amex loyalist who enjoys their curated experiences and can easily utilize their specific credits? Or do you prefer the CSR's more straightforward, flexible travel credit and its new, higher earning rates on diverse travel bookings?

Making Your Move: Deciding Which Premium Travel Card Is Right For You

With so many compelling options, making the right choice can feel overwhelming. Here's a framework to help you decide which premium travel card (or combination of cards) offers the best value for you.

Decision Criteria: Your Personalized Checklist

- Your Spending Habits:

- Where do you spend the most? Dining and groceries (Amex Gold)? General travel (CSR, Venture X)? Everyday expenses (Venture X 2x)? Flights (Amex Platinum, CSR)?

- Can you easily maximize the credits? Be honest. If a card offers $300 in specific airline incidentals but you rarely fly that airline, it's not worth $300 to you. The CSR's broad $300 travel credit is easier to use for most.

- Your Travel Frequency & Style:

- How often do you travel? The more you travel, the more likely premium cards with lounge access, travel protections, and earning bonuses make sense.

- Where do you stay? Are you loyal to Hilton (Aspire)? Do you seek luxury independent hotels (Amex FHR/THC, Chase "The Edit")? Or are you flexible?

- Do you value lounge access? If you frequently fly and enjoy airport lounges, prioritize cards with robust lounge networks. Consider which lounges you'd use most.

- Are travel protections a priority? The peace of mind from primary rental car insurance, trip delay, and cancellation coverage can be invaluable.

- Your Redemption Preferences:

- Do you prefer fixed-value redemptions? (e.g., points worth 1-1.5 cents towards travel bookings).

- Are you interested in transferring points to airline/hotel partners? This is where Chase Ultimate Rewards and Amex Membership Rewards truly shine, offering potentially outsized value.

- How good are the transfer partners? Both Chase and Amex have excellent partners, but check if your preferred airlines or hotel chains are on their lists.

- Tolerance for Annual Fees:

- Can you realistically offset the annual fee with the benefits you will use? Don't fall for the "potential value" trap if you know you won't use a credit.

- Consider the effective annual fee after accounting for credits you reliably use.

Pitfalls to Avoid

- "Shiny Object Syndrome": Don't apply for a card just because the welcome bonus is huge or a friend has it. Ensure it aligns with your spending and travel patterns.

- Not Maximizing Credits: Premium cards are only worth it if you actively use their benefits. Set reminders for monthly or annual credits.

- Ignoring the New CSR Changes: Don't assume your old value proposition for the CSR still holds. Recalculate based on the new fees and redemption structure.

- Canceling Too Soon: If you decide to move on from a card, always consider downgrading (product changing) first to preserve credit history and points, especially with Chase.

Frequently Asked Questions (FAQs)

Can I still get good value from the Chase Sapphire Reserve with its new annual fee?

Yes, for some. The value of the CSR depends entirely on your ability to utilize its remaining benefits. If you consistently use the $300 flexible travel credit, access Priority Pass lounges, benefit from the new "The Edit" hotel collection credit, and earn heavily on the 8x Chase Travel or 4x direct flight/hotel categories, it could still be worth it. However, the bar for justification is now much higher, requiring you to get almost $500 in value beyond the initial $300 travel credit.

What's the best way to downgrade my CSR if I decide to switch?

The best way is to call Chase directly and request a product change. You can switch to a card like the Chase Sapphire Preferred ($95 annual fee) to keep some travel benefits and the 1.25x redemption rate, or to a no-annual-fee card like the Chase Freedom Unlimited or Chase Freedom Flex to keep your account open and points alive without paying an annual fee. Remember, your account must be at least 12 months old.

Are there any other hidden fees to watch out for with premium travel cards?

While most premium cards proudly list their annual fees, always check for authorized user fees (which are increasing for both CSR and Amex Platinum), foreign transaction fees (though most premium travel cards waive these), and any specific fees associated with certain benefits (e.g., booking fees through proprietary travel portals, though less common now). Also, be aware that some credits require enrollment or careful tracking (like Amex's airline fee credit).

How do I determine the actual value of travel points?

The value of points is fluid. For fixed-value redemptions (e.g., booking travel through Chase Travel portal), it's straightforward: 1.25 cents per point for CSP, or the new "Points Boost" value for CSR. For transferable points (like Ultimate Rewards or Membership Rewards), the value can be much higher when transferred to airline or hotel partners for aspirational travel (e.g., business or first-class flights). Many experts value these points at 1.5-2 cents each, but this requires research and flexibility to find great deals.

Your Next Steps to Smarter Premium Travel

The premium credit card market is competitive, offering more choices than ever before. The recent changes to the Chase Sapphire Reserve, while significant, aren't necessarily a death knell for the card, but they are a wake-up call for thoughtful evaluation.

- Audit Your Current Spending: Look at your last 6-12 months of credit card statements. Where do you spend most? Dining? Travel? Groceries? General purchases? This will tell you which card's bonus categories will serve you best.

- Define Your Travel Goals: Do you travel frequently for business, seeking comfort and lounges? Are you a family traveler looking for cost savings and basic protections? Do you chase aspirational redemptions like business class flights?

- Compare Benefits Against Your Needs: Don't just look at the list of perks; quantify how much value you will realistically extract from each one. How much is that lounge access worth to you? Will you actually use all the various credits?

- Consider a Multi-Card Strategy: It's common for savvy travelers to combine cards (e.g., an Amex Gold for dining/groceries and a Venture X for general travel and lounges) to maximize rewards across categories.

- Don't Rush, But Don't Procrastinate: If you're a current CSR holder, you have some time before all the changes take full effect. Use this grace period to thoroughly research, compare, and make a confident decision that aligns with your financial and travel aspirations.

The best premium travel card isn't a universal answer; it's the one that best fits your unique life. By taking the time to understand the nuances of the Chase Sapphire Reserve vs. competitors, you'll be well-equipped to unlock superior value and elevate your travel experiences.